Last Updated on December 11, 2024 by Satyendra

Running a business involves much more than simply providing services or products. There are several rules. Compliance cannot be ignored, whether it is in how you handle consumer data, obey environmental standards, or even treat your staff. Why? Because cutting corners can have unintended consequences.

Ignoring regulations can lead to disastrous consequences, including hefty penalties and a terrible reputation. On the other hand, keeping up with compliance? This could provide you with a competitive advantage. It demonstrates that you are trustworthy, ethical, and prepared for any challenges the market or the law may throw at you.

What is Compliance Management?

Compliance management is the overall approach of ensuring that a business organization meets legal obligations, regulations, company standards as well as contractual conditions. It covers all aspects from making sure that data has been processed always in compliance with privacy regulations, working conditions, safety, and ethical accounting. In its most basic form, compliance management means ensuring and promoting compliance with the legal and ethical requirements while keeping the organizational costs optimal.

Four Pillars of Compliance

- Know the laws: Each industry has its own set of rules, some more complex than others. If you work in finance, you must comply with regulations such as PCI-DSS. When it comes to healthcare, you will be responsible for HIPAA. Someone in your company must stay current on these.

- Implement Internal Policies: implement clear internal policies and procedures that outline legal, ethical, and operational standards for all employees. These should include guidelines on data security, reporting, and conduct to ensure everyone understands their compliance responsibilities.

- Do Not Ignore Risk: The tough issue about compliance is that things change. What worked last year may not work this year. You must identify areas of your organization where it may be vulnerable to breaching the regulations and ensure that you have safeguards in place to prevent this.

- Keep Your Promises: If you’ve signed a contract with a vendor or a customer, be sure you’re meeting your duties while avoiding any compliance difficulties. Many companies make the mistake of believing that contracts are independent of regulatory duties.

Why Compliance Management is a Continuous Process

Unlike some company operations, compliance management demands constant attention. Why? Because the rules constantly change.

Regulations, particularly those governing privacy and data security, are continually evolving. For example, GDPR and other data privacy rules have presented new obstacles to organizations in recent years. To be compliant, businesses must continuously change their rules and processes.

Furthermore, as firms grow, their risks shift. What was once a modest business operating in one state may now extend across borders, bringing with it new sets of rules. Keeping up with all of these changes necessitates continuous attentiveness.

The Importance of Compliance Management

Having said that, why is compliance management so critical? First, let’s address the obvious: penalties. Noncompliance can lead to fines, legal actions, and loss of operating licenses in addition to fines and legal actions. But financial repercussions are only the tip of the iceberg. There is also the loss of reputation. With the rise of social media and the news, the breach of compliance is like a wildfire that does not even take a day or hours to erupt and spread around the globe. It takes a long time to restore the damaged reputation compared to the short span that takes to lose customers, investors, and staff.

Also, compliance management serves with the creation of a culture of ethical practices and responsibilities. This promotes respect for legal standards and ensures that employees do not engage in prohibited activities as they understand that their organization has put procedures in place to uphold the law. This not only makes daily operations of the business run smoothly but also enhances the employees’ loyalty and confidence in the organization.

Download Whitepaper

Take something simple like data privacy for instance. Currently, with regulations such as the GDPR for European companies or the CCPA for a US company, the consumer is a lot more informed. They would like to understand that their given information is secure. This is the reason why businesses that have embraced the concepts of compliance are always in a better position to develop long-term consumer relationships. They achieve a higher competitive advantage because customers tend to trust businesses that operate ethically and protect their data.

Compliance management also plays a protective role against internal threats When it comes to compliance, the issue is the prevention or at least minimization of damaging or disastrous consequences in the instance of both internal and external threats. A compliance program is a system that can be implemented and explained to the employees in a corporate organization to reduce the chance of workers perpetrating fraud, leaking important information, or other form of unethical practices.

Challenges in Compliance Management

Managing compliance is not without its obstacles. Here are some of the main challenges companies face:

- Changing regulations: Laws and regulations can change quickly, leaving firms struggling to keep up.

- Resource Limitations: It can be difficult for smaller firms to devote time and money to compliance.

- Employee Buy-In: Ensuring that all employees follow compliance processes can be difficult, especially if they believe the procedures are unduly restrictive or unrelated to their duties.

- Global Operations: For organizations that operate worldwide, compliance might include navigating a tangle of various laws and regulations.

- Documentation: Tracking compliance and maintaining correct documents for audits can be difficult, especially as a business grows.

How to Implement a Compliance Management Program

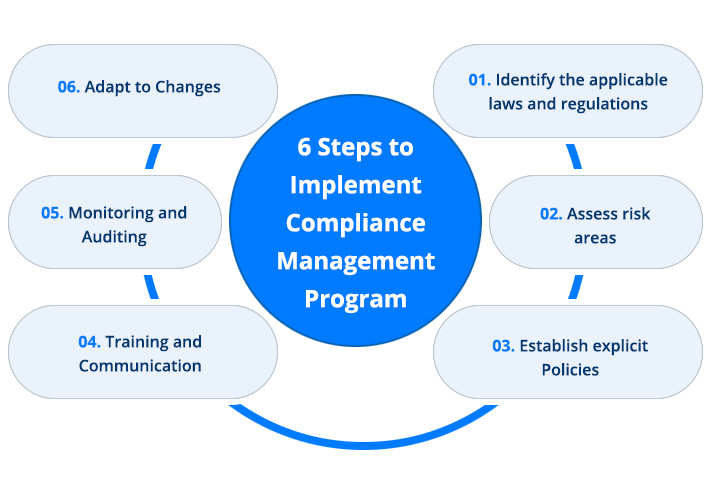

Implementing an effective compliance management program necessitates an organized strategy. Here’s how you can accomplish it:

- Identify the applicable laws and regulations: First and foremost, choose which rules your firm must obey. These may vary depending on your industry, region, and nature of your operations.

- Assess risk areas: Not all aspects of your firm will face the same level of compliance risk. Concentrate on the areas where infractions may have the greatest impact.

- Establish explicit Policies: Once you’ve determined what needs to be done, provide explicit rules that detail how your organization will meet compliance standards.

- Training and Communication: Ensure that your employees are well-versed in compliance regulations. Schedule regular training sessions to keep everyone up to date.

- Monitoring and Auditing: Compliance monitoring and auditing are not “set it and forget it” processes. Regular monitoring and audits will help your organization maintain compliance over time.

- Adapt to Changes: As legislation changes, your compliance program must develop alongside. Make modifications as needed.

Common Approaches to Compliance Management

Companies approach compliance management in different ways, based on their resources and the complexity of their operations. Here are some of the most popular approaches:

- Manual Tracking: Some firms conduct compliance manually, using spreadsheets and other tools to monitor adherence to rules. This method is effective for small businesses but can become cumbersome as the firm grows.

- Compliance Software: For larger firms, investing in specialized compliance software is frequently the most effective approach to handling compliance. Many of the more time-consuming tasks of compliance management, such as tracking regulatory changes and creating audit reports, can be automated using these solutions.

- Outsourcing: Some firms choose to delegate compliance management to third-party professionals. This is especially widespread in highly regulated industries such as finance and healthcare, where noncompliance carries serious consequences.

How Lepide Helps

Lepide Data Security Platform offers a complete solution for streamlining and automating compliance management for businesses of all sizes through real-time monitoring of data changes, permissions, and configurations, helping organizations adhere to standards like GDPR and HIPAA. It facilitates compliance with detailed audit trails for issue response, especially valuable for industries needing stringent regulatory records. Additionally, Lepide automates reporting with pre-defined, customizable reports aligned with standards such as SOX, GDPR, and PCI-DSS, which can be scheduled to ensure streamlined, consistent reporting.

Conclusion

Compliance management is no longer just a legal obligation; it is a strategic need for firms seeking to foster trust, manage risks, and increase operational efficiency. While the hurdles are enormous, the benefits of a strong compliance management program are numerous, ranging from avoiding costly penalties to improving relationships with customers and stakeholders.

Understanding your regulatory environment, conducting risk assessments, adopting resilient policies, and regularly reviewing your compliance activities will help shield your firm from the legal and reputational risks of noncompliance.

If you want to know more about how Lepide helps in better compliance management, schedule a demo with one of our engineers today.

Group Policy Examples and Settings for Effective Administration

Group Policy Examples and Settings for Effective Administration 15 Most Common Types of Cyber Attack and How to Prevent Them

15 Most Common Types of Cyber Attack and How to Prevent Them Why AD Account Keeps Getting Locked Out Frequently and How to Resolve It

Why AD Account Keeps Getting Locked Out Frequently and How to Resolve It